Simple Mobile Finishes 2022 Atop Wave7 Research Prepaid Dealer Quarterly Survey

- Best MVNO

- Dec 28, 2022

- 3 min read

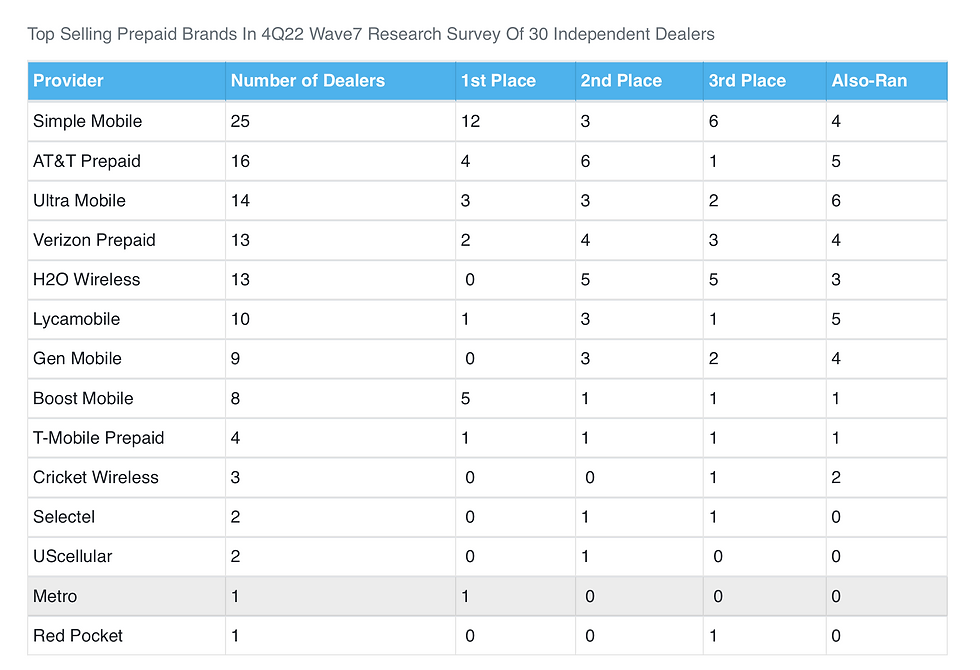

Wave7 Research's 4th quarter 2022 independent multi-carrier prepaid dealer survey results are in. And for the 32nd straight time, for as long as Wave7 Research has run the survey, Simple Mobile has come out on top. The Verizon-owned brand was sold in 25 out of 30 dealer stores surveyed. It was the top-selling brand in 12 of the stores, the lowest total in the last eight surveys. In the Wave7 Research 3Q22 prepaid dealer survey, Simple Mobile was the top-selling brand in 16 locations down from 19 in the 2Q22 survey.

For the first time ever, PagePlus, Net10, and GoSmart were not found in any dealer stores surveyed. As previously noted by NWIDA, and Fierce Wireless, the brands were scheduled to be pulled from dealer stores on 11/1/22. Dealers can no longer activate the brands but can continue refilling airtime for existing customers. Potential customers of each brand can still activate new service online.

4Q22 Prepaid Dealer Survey Results

Note: The "number of dealers" column indicates the number of dealers out of 30 selling the brand. The "1st place" column denotes the number of dealers reporting the brand as their top seller, while "2nd place" etc., means the number of dealers reporting that as their second best-selling brand.

Aside from Simple Mobile, Wave7 Research once again named AT&T Prepaid as one of its survey winners. AT&T Prepaid was a top seller in four of the stores surveyed compared to being a top seller in zero stores in the 3Q22 survey. AT&T finished number two overall in the number of stores carrying the brand, a spot that it has maintained since Wave7 Research's 2Q22 survey.

Wave7 Research Quarterly Prepaid Brand Momentum Award

Wave7 Research gave Gen Mobile its momentum award in the quarterly survey and named Lycamobile an honorable mention.

In previous surveys, Gen Mobile was typically mentioned by at best one dealer. But the brand started surging in the 3Q22 dealer survey where it was mentioned as being carried by 9 of the 30 dealers surveyed. That number is unchanged in the 4Q survey, however, Gen Mobile was named a top two or three seller by five of the dealers activating the brand. In the 3Q22 survey, just three dealers had it as a top three-selling brand.

Lycamobile meanwhile has seen a bit of a rejuvenation. The brand was sold in ten of the stores surveyed, up from six stores in the previous survey. One dealer even named the brand as its top seller, whereas no dealers had it as a top seller in the 3Q22 survey. Wave7 Research is unclear on what is driving the brand's growth. The firm said one possibility may be due to several Tracfone brands leaving the channel and dealers looking for alternatives to replace them. Supporting that idea is a recent Facebook post by a Lycamobile master agent encouraging prepaid wireless dealers to "discover new alternatives to earn more," and to "become a Lycamobile authorized retailer today." Lycamobile USA meanwhile is looking to hire marketing and branding reps to help grow the brand as seen in this Facebook post.

Lycamobile did run a lot of aggressive promos during the quarter that could have also helped to drive growth, but it's unknown if any were available in stores or if they were just online only.

Survey Losers

Wave7 Research named Net10, PagePlus, and GoSmart Mobile as its survey losers. Obvious choices given that dealers can no longer activate the brands for new customers. Net10 did have a fairly strong presence in the Wave7 Research 3Q22 survey. It was sold by 14 of 30 dealers surveyed, while GoSmart was found in six stores, and PagePlus in five. Also missing from the survey were Total Wireless (now Total by Verizon) and Tracfone. Each brand was carried by a single dealer in the 3Q22 survey, while in the 2Q22 survey Tracfone was sold by three dealers and Total by five.

“There were seven Verizon/TracFone brands mentioned in the 3Q22 dealer survey, but only two were mentioned in the 4Q22 survey – Simple Mobile and Verizon Prepaid. It seems likely that AT&T’s two prepaid brands and some independent brands are likely to gain activation share in the independent multi-carrier dealer channel.” – Jeff Moore, Principal of Wave7 Research

.png)

Comments